Trading sessions in trading | KillZone | Forex Market Cycles | Free Smart-Money Training

Hello everyone, this is a series of training articles on the Smart Money trading strategy (Smart-Money Concept) from the WildMoneyPro project. In this article we will tell you in detail about trading sessions and KillZone. And if you want to understand the concept in more detail, we recommend our telegram channel @WildMoneyPro

Trading sessions in trading

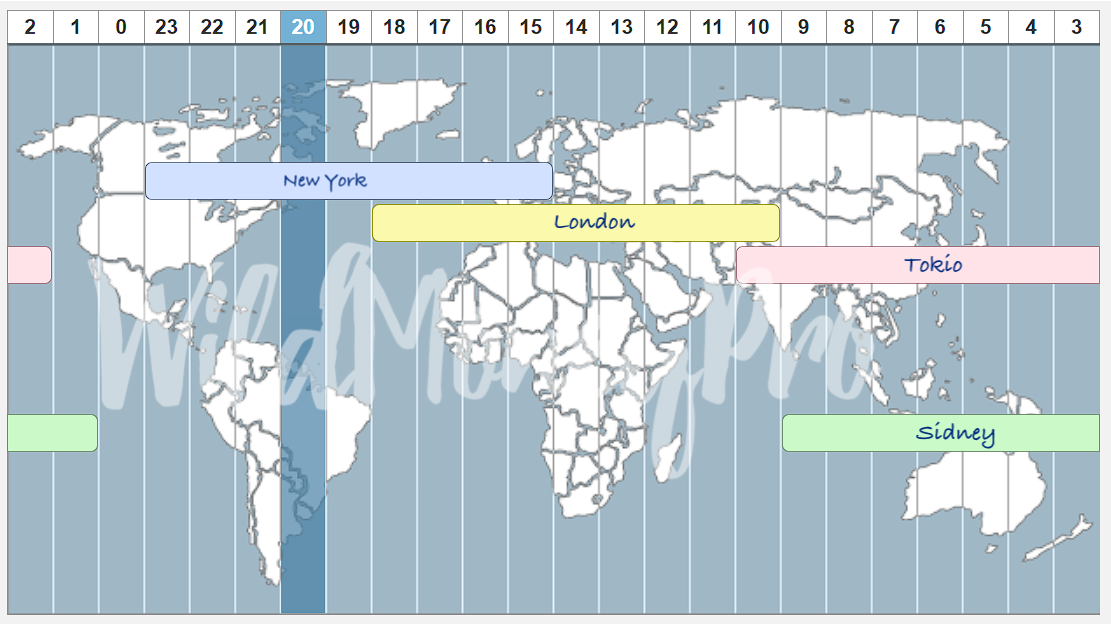

For successful trading in financial markets, it is necessary to know about trading sessions. This is the time when the market is open for trading, and when most of the price movement takes place on it. In this article, we will look at the main trading sessions and how they affect trading.

Asian session (01:00-11:00, UTC+3, daylight saving time)

London session (10:00-19:00, UTC+3, summer time)

Tthis is the time when assets are traded in Europe. Stocks, currencies and other assets from Europe are traded at this session. Forex is characterized by the withdrawal of liquidity from the Asian session. The first main session, which usually sets the main pace of the direction of the day. If a strong trending price movement is formed during the London session, then we should expect a deep correction or a trend reversal during the next New York session.

American session (15:00-00:00, UTC+3, daylight saving time)

This is the time when assets are traded in North and South America.Stocks, currencies and other assets from the USA, Canada and Latin America are traded at this session. The second main session for trading.The most volatile session, in which price manipulation is most often observed. If the price is in a sideways movement during London, then there will usually be a strong impulse price movement in New York.

Liquidity of trading sessions

The liquidity of sessions is a magnet for prices and large capital will seek to take away the pools of liquidity that are formed behind the highs and lows of trading sessions.

Session highs and lows

Determining session highs and lows is a task that can be solved using the session range indicator, which will automatically mark the maximum and minimum for the session period. However, if you prefer to work without indicators, you can manually highlight these places by simply marking the beginning and end of sessions. Regardless of what liquidity was in the market during the session – absorbed or formed, such information can help you determine the further direction of trading during the day.